|

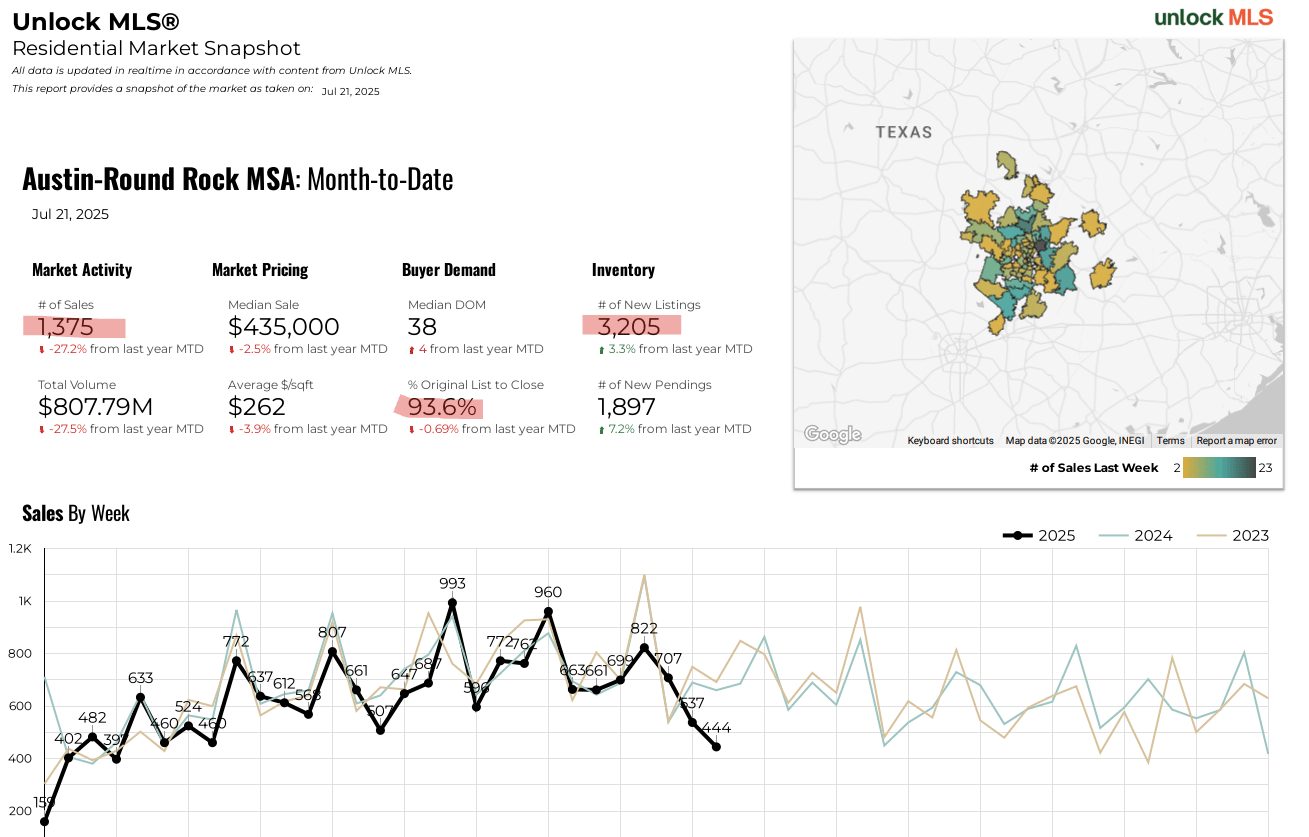

The Austin housing market is showing signs of stabilization in 2025, with median home prices holding steady and inventory levels rising, marking a shift from the dramatic price surges and rapid demand seen in the pandemic years. After peaking during the 2020-2021 pandemic boom—when median home prices surged over 60% fueled by remote-work-driven migration—the market has cooled significantly due to multiple factors including interest rate increases and economic uncertainties.

|

|

Key 2025 indicators from Austin’s housing market reveal:

|

|

|

-

Median Sales Price: $449,900 (unchanged year-over-year)

-

Closed Sales: Up slightly by 2.8%

-

Months of Inventory: Increased to 5.5 months, showing more supply availability

-

Active Listings: Up 18.2%, reflecting growing inventory

-

Average Days on Market: Increased, suggesting slower sales pace

-

Average Close to List Price: Slightly lower at 93.9%, indicating reduced bidding competition

|

|

This data reflects a shift from “seller’s market” conditions to a more balanced market. A surge in new construction post-pandemic helped absorb demand, preventing extreme price spikes or a sharp crash. The city council’s recent zoning changes allowing denser housing development—such as reducing minimum lot sizes and enabling multiple homes on single lots—are aimed at sustaining housing supply growth and affordability over time.

|

|

However, challenges remain. Economic concerns such as tariffs and recession risks have made buyers more cautious, contributing to near-historic high inventory levels and a slowdown in second-home purchases, which dropped by over 60% in 2023. While some view this slump as a “housing market trouble,” experts also see it as a healthy cooling after an overheated market and an opportunity for Austin to adapt.

|

|

Overall, Austin's housing market is transitioning from its pandemic-era boom into a more moderate, sustainable phase. The combination of increased housing supply, policy reforms, and a stabilizing economy points toward a balanced market with controlled price growth, though potential risks remain that could affect buyer sentiment going forward.

|

|

This stabilization suggests Austin is moving toward a more resilient housing environment, serving as a potential model for fast-growing cities facing similar market pressures.

|

|

|

|

|

|